Why You Need Disability Insurance.

You Need Disability Insurance if You Have a Family Budget (by yourself or with a spouse), and Fund (in part or full) that Family Budget With Your Earned Income.

An example: Jessica is an architect working in a Triangle area firm with an $105,000 annual income ($8,750 gross monthly). After Federal and State taxes and saving for retirement. she brings home to her family budget $6,000 monthly.

Jessica and her spouse share a family budget. The mortgage, auto and student loans, utilities, mobile phones, groceries, insurance, etc. Each month. Her income funds approximately 60% of the family budget, and his income covers 40%.

Their family budget is funded. No worries!

But….what if an illness (90% of disabilities) or injury (10% of disabilities) sidelines Jessica? What if she cannot work in her occupation as an architect, and cannot fund her family budget for the next few months? For the next 2 years? Or 20 years?

Disability Income Insurance answers that important question, replacing income as a monthly benefit when you cannot work because of a debilitating illness or injury that leaves you disabled and unable to work.

The Disability Insurance policy we designed for Jessica features a $6,000 monthly benefit, which replaces current take home pay. (the DI benefit is not taxed, so she will be able to use $6k monthly), and would begin just 90 days after her disability that prevented her from working began.

The $6k monthly benefit would continue until her attending physician says she could return to work, or if she were permanently disabled, until age 67, her retirement age.

Key Facts and Figures to Consider in Thinking of Your Need for Disability Insurance.

Only 28%

A survey found that only 28% of U.S. households have enough savings to cover 6 months of their family budget if they were unable to work and earn their income.

Only 40% of households could cover 3 months of expenses.

1 in 4

1 in 4 of today’s 20 year olds will suffer a disability and be unable to work for a specified time before age 67, (Social Security retirement age).

Those are not good odds in “hoping” you do not need DI coverage.

Only 10%

Only 10% of disabilities that prevent someone from working for at least 3 months are due to injury, at work or somewhere else.

Fully 90% of disabilities are due to illness!

40% of Families

40% of families say they would have a hard time quickly covering an unexpected $400 expense.

A disability would further erode their family budget, maybe for years.

28% of Claims

28% of long term Disability claims with insurers are musculoskeletal disorders.

Other large claims types are for cancer, mental health, injuries and heart related illness.

$1,000,000+

The income you earn over your lifetime* will be $1 million+!

This future earning power you hold is your greatest asset. It needs to be protected with Disability Insurance.

*A 27 year old working until retirement at age 67 earning $25,000 annually will earn $1 million in their lifetime. For most people the number will be much higher, most likely millions.

What is Disability Insurance? What is a DI Policy?

Disability Income Insurance is a contract made between you and an insurance company, just like the automobile and health insurance you have now. To oversimplify, any insurance policy asks you to pay a monthly premium cost, and in return the insurance company makes specific promises to you.

Premium Cost: DI Insurers tell us the average premium cost of an individual Disability Insurance policy is approximately 1-3% of your income.

Use your calculator app to get a quick idea of cost….what is your monthly income? Multiply that by 1%. Multiply your monthly income by 3%. That will give you a quick ballpark cost range.

Promises made: The insurance company makes the promise it will pay, if you are disabled and cannot work, a specific benefit amount of money to you each month.

This specific benefit amount, electronically deposited into your checking account each month, is there to replace your lost income, so you can continue on funding your family budget even though you cannot work due to the disabling injury or sickness.

The monthly benefit amount you chose begins a few months (usually 30, 60 or 90 days) after your disability stops you from working, and continues until you can return to full-time work, or until your benefit period in the contract (insurance policy) ends (this benefit period can be 5 or 10 years, or until your retirement age; 65, 67 or 70).

Disability Insurance is a “promise” that you have “options.”

Disabled people with strong Disability Insurance benefits have fewer financial worries, as the insurance company offering the policy has made the promise to continue monthly benefits as income replacement.

This gives the insured person the “options” they want. They have the options to continue their financial life as it was, as their current family budget can remain funded.

Or they have the options to make changes. But those change decisions are not necessitated by not having enough money to pay for their current bills, costs and savings plans.

A disabled person without Disability Insurance does not have options. They will need to make changes to their family budget (cutting down on groceries, extras, etc.), or risk default with unpaid bills, etc.

Their savings will run out, and Social Security Disability benefits are not enough to fund a family budget.

More Details on Disability Insurance Policies.

These explanations of Disability Insurance have been very general, to explain the idea. For details on each part of a Disability Income Insurance policy see the page entitled “Policy Walk-Through” or click the button to be taken there.

A Real Life Example That Illustrates the Importance of Disability Insurance.

Real life examples really help illustrate how Disability Insurance saves families financially in the case of a disability, and allows for the lives they have built to continue.

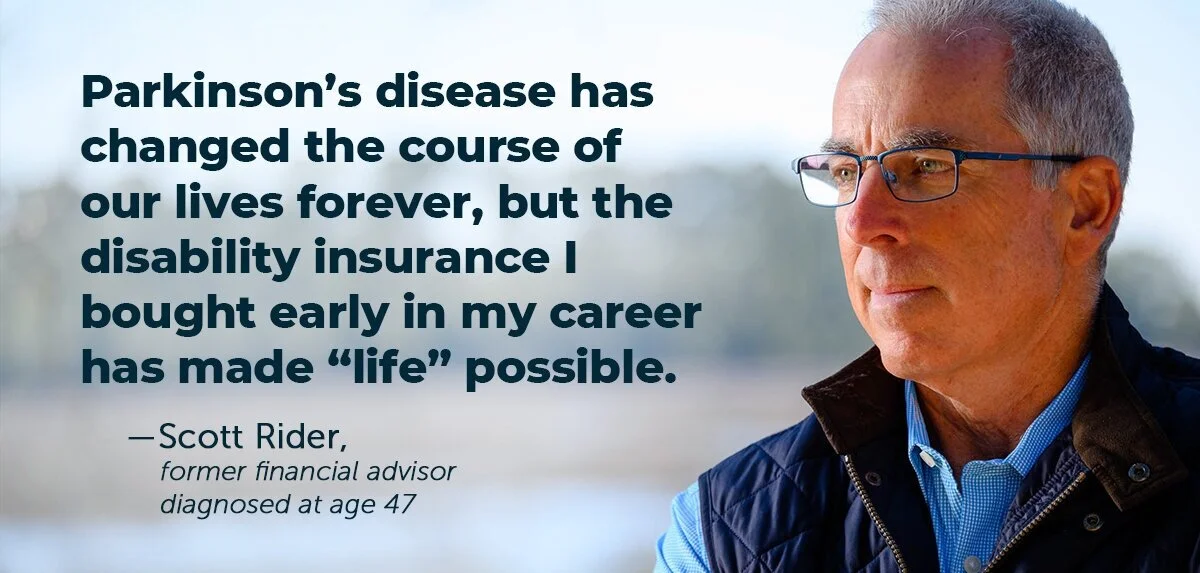

For Scott Rider, it wouldn’t be a stretch to say that running was his life. In college he was a three-time conference champion, and a two-time All American. His running sustained him as he charted out his career as a financial services consultant. And his running continued as he married his high-school sweetheart, Kelly, and helped their three children.

Running is also how he found out his life was changed forever.

It began subtly, when Scott’s toes didn’t “work as they should” and interfered with his running. He soon learned he had Parkinson’s disease.

“I remember the day I found out. As I stood outside the doctor’s office, on the sidewalk on a warm fall day, I knew my life—and my family’s—was changed forever,” says Scott.

His day-to-day routines have changed drastically since being diagnosed at just 47 years of age. Cognitive and physical limitations mean he had to give up the financial services business he built and loved.

And he now relies on Kelly to help him with tasks most people take for granted, like tying his shoes.

One important detail has not changed. He and his family have been able to maintain their lifestyle, thanks to the disability insurance he purchased. He got it when he was just starting out in his career and added to it as his salary grew.

His disability insurance now replaces a significant portion of the income he once earned each month. It has allowed Kelly to remain a stay-at-home mom and now be a caregiver to Scott.

The benefit also helps them meet Scott’s growing medical needs.

The couple has been able to put their three children through college and give their daughter the wedding of her dreams. They’ve even reached a retirement goal of moving to a warmer climate. All of this was made possible by Scott’s disability income insurance.

“Without it, I don’t know where we’d be,” says Scott. “I feel fortunate that I understood early on that my income was my most valuable asset, and that I needed to insure it (with Disability Insurance).”